carbon1.online Market

Market

Why Are Refi Rates Higher Than Purchase

Refinance rates are the interest rates lenders offer when you're replacing your current mortgage with a new loan, often with different terms or conditions. As. What are the pros and cons of refinancing? · You'll pay closing costs — or higher rates, in the case of a loan that claims to have no closing costs. · Depending. purchase up to one mortgage discount point in exchange for a lower interest rate. Connect with a mortgage loan officer to learn more about mortgage points. Refinance rates are generally higher compared with mortgage purchase rates. Generally, rates are higher to account for a slightly greater risk for refinance. The rate you may qualify for is based on a variety of factors. In addition to property type, credit history and LTV, other factors may include loan purpose. Why Refinance? Refinancing to a lower interest rate may reduce your monthly mortgage payment and increase your cash flow. Refinancing when interest rates. As mortgage rates have risen in recent years, there's a good chance that any refinance rate you qualify for now will be higher than your existing one. Cash-out refinance rates are typically higher than regular refinance rates due to the increased loan amount and associated risk. Several factors, including. Cash-out loans generally come with added fees, points, or a higher interest rate, because they carry a greater risk to the lender. Compare Today's Best Mortgage. Refinance rates are the interest rates lenders offer when you're replacing your current mortgage with a new loan, often with different terms or conditions. As. What are the pros and cons of refinancing? · You'll pay closing costs — or higher rates, in the case of a loan that claims to have no closing costs. · Depending. purchase up to one mortgage discount point in exchange for a lower interest rate. Connect with a mortgage loan officer to learn more about mortgage points. Refinance rates are generally higher compared with mortgage purchase rates. Generally, rates are higher to account for a slightly greater risk for refinance. The rate you may qualify for is based on a variety of factors. In addition to property type, credit history and LTV, other factors may include loan purpose. Why Refinance? Refinancing to a lower interest rate may reduce your monthly mortgage payment and increase your cash flow. Refinancing when interest rates. As mortgage rates have risen in recent years, there's a good chance that any refinance rate you qualify for now will be higher than your existing one. Cash-out refinance rates are typically higher than regular refinance rates due to the increased loan amount and associated risk. Several factors, including. Cash-out loans generally come with added fees, points, or a higher interest rate, because they carry a greater risk to the lender. Compare Today's Best Mortgage.

to an earlier mortgage (both purchase and refinance) and lets This suggests that as interest rates decline and property values increase, we should expect to. Rate-and-term refinances generally have more favorable interest rates and allow for higher loan-to-values (LTVs) than cash out refinances. A rate-and-term. Ideally, this new loan comes with better terms than your old one. This depends on a number of factors, including current mortgage rates, how much equity you. Your new mortgage will be higher than the balance of your current one, but you will get the difference in cash, to spend now, on anything you want. Some more. While both involve home loans, refinance mortgages typically have higher rates than purchase mortgages because they pose a greater risk for. Shop rates and compare closing costs: Home equity loan rates are typically higher than mortgage rates, but often have lower closing costs than a refinance loan. Refinancing your existing mortgage just means replacing it with a new loan—albeit one with a better interest rate, different term, or some other benefit to you. Some borrowers opt for a higher interest rate to get lender-paid mortgage insurance (LPMI). Interest rates on mortgage refinances are usually lower than home. Though the rates on a cash-out refinance may be slightly higher than they The rates shown above are the current rates for the purchase of a single. Eligible veterans and service members find that rates are generally lower with a VA home loan than a conventional mortgage. As of today, August 30th, , the. So, paying a higher interest rate on a mortgage refinance might be a good financial decision if that higher rate is still lower than the interest rates on your. Shorter terms (year loans) generally offer better interest rates than longer terms (year). Fees are another detail to factor into your overall payment. Cash-out refinance rates are higher than typical purchase rates because there is greater risk involved. By taking cash out of your home, the home loan balance. APRs are usually higher than interest rates because they include additional costs on top of the interest rate. The higher the risk, the higher the mortgage. Refinancing to a longer term may lower your monthly payments, but may also increase the total interest paid over the life of the loan. Refinancing to a shorter. Lenders charge higher rates if your loan is a second mortgage, like a home equity loan or home equity line of credit (HELOC). If you can lower your interest. rate. The minimum rate is %. Rates can increase or decrease no more than 2% each year and 6% total. House. We're happy to help! Meet the Mortgage Team. HELOC interest rates are attached to the Primate Rate, which is usually higher than rates on the mortgage-backed securities market, so you may receive an. Cost Calculator to estimate your total closing expenses for purchasing ARM interest rates and payments are subject to increase after the initial fixed-rate. Make purchases with less interest: Financing expensive purchases with your home's equity lets you take advantage of a lower interest rate than what's typically.

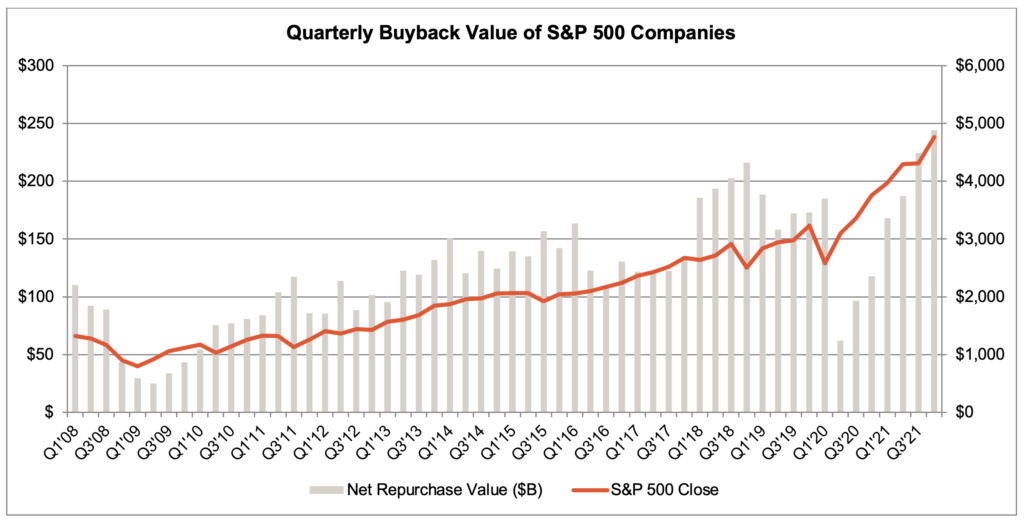

Stock Buyback News

As of today's date, the Company has repurchased $5,, in shares of its common stock, which includes an additional 2,, shares in new purchases since. Share repurchase, also known as share buyback or stock buyback, is the reacquisition by a company of its own shares. Buybacks are a great tool to reward shareholders — but timing has to be right. Mon, May 22nd Squawk on the Street Activision beats earnings estimates. Share buybacks enable companies to raise shareholder value. Under normal market conditions, the portion of profits a company uses to buy back shares should. Repurchases of Novartis shares are carried out on a second trading line on the SIX Swiss Exchange, with Novartis as the exclusive buyer. During this two-year experiment, share repurchases fell by 21 percent for firms facing higher tick sizes, while dividend payouts were unchanged. This effect was. Nucleus Software stock hits 20% upper circuit as board to consider share buyback on Aug Stock buybacks are when companies buy back their own stock from shareholders on the open market rather than investing in workers or equipment. A stock buyback, also called a share repurchase, is a corporate finance strategy in which a company buys its stock from the market, reducing the number of. As of today's date, the Company has repurchased $5,, in shares of its common stock, which includes an additional 2,, shares in new purchases since. Share repurchase, also known as share buyback or stock buyback, is the reacquisition by a company of its own shares. Buybacks are a great tool to reward shareholders — but timing has to be right. Mon, May 22nd Squawk on the Street Activision beats earnings estimates. Share buybacks enable companies to raise shareholder value. Under normal market conditions, the portion of profits a company uses to buy back shares should. Repurchases of Novartis shares are carried out on a second trading line on the SIX Swiss Exchange, with Novartis as the exclusive buyer. During this two-year experiment, share repurchases fell by 21 percent for firms facing higher tick sizes, while dividend payouts were unchanged. This effect was. Nucleus Software stock hits 20% upper circuit as board to consider share buyback on Aug Stock buybacks are when companies buy back their own stock from shareholders on the open market rather than investing in workers or equipment. A stock buyback, also called a share repurchase, is a corporate finance strategy in which a company buys its stock from the market, reducing the number of.

Third Tranche of Share Buyback Program. A List of Trades will be disclosed below for each week in which shares are purchased. The share buyback programmes are executed within the limitations of the existing authority granted by the General Meeting on 24 May The shares are. Overview of purchases completed under the buy back programs ; beginning 02/26/, 5,,, ; 08/14/ − 02/14/, 7,,, ; 08/01/ −. “On 2 May , ING announced a share buyback programme under which it plans to repurchase ordinary shares of ING Groep N.V., for a maximum total amount of. Shell plc (the 'Company') today announces the commencement of a $ billion share buyback programme covering an aggregate contract term of approximately. Share buybacks have soared to a new record almost matching dividends in (latest data), according to a special supplement of the Janus Henderson Global. Third Tranche of Share Buyback Program. A List of Trades will be disclosed below for each week in which shares are purchased. In simple words, buyback is nothing but a company buying back its shares from the existing shareholders. A company can announce a buyback offer either through a. Company believes stock is significantly undervalued and is trading at a significant discount to current cash position of approximately $ million Buyback. The schedule of Treasury Securities buybacks is released at the Treasury's Quarterly Refunding press conference, usually held on the first Wednesday of. Stock buybacks are when companies buy back their own stock from shareholders on the open market rather than investing in workers or equipment. As of today's date, the Company has repurchased $5,, in shares of its common stock, which includes an additional 2,, shares in new purchases since. ASML reports transactions under its current share buyback program · 1 · 2 · 3 · 4 · 5 11 · Sign up for news alerts · Home · News · Share buyback. Learn. Share buybacks · August 7 SoftBank Group Corp · SoftBank sets out buyback plans after market rout · August 7 Commerzbank AG · Commerzbank targets. The schedule of Treasury Securities buybacks is released at the Treasury's Quarterly Refunding press conference, usually held on the first Wednesday of. On October 26, , the Board of Management decided to terminate the remaining ongoing share buyback program ahead of schedule on October 26, This. Following publication of the first quarter results press release dated 4 May (the 'ER Press Release')[1], ArcelorMittal announces a new share buyback. This buyback program of up to CHF 20 billion is due to be completed by the end of December Share buyback announcement (French, German) Annonce: Rachat d'. In the first two quarters of , Alphabet spent $23 billion on the buyback process. The total number of the company's outstanding shares is million. If.